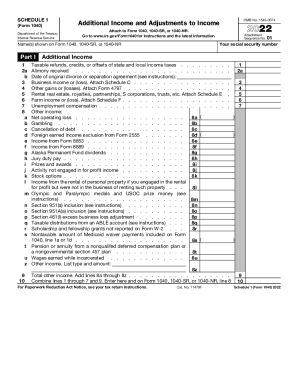

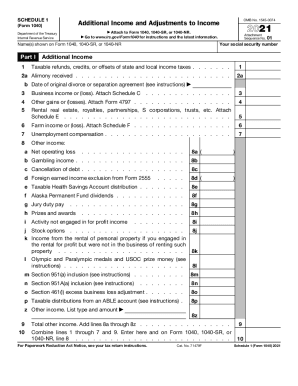

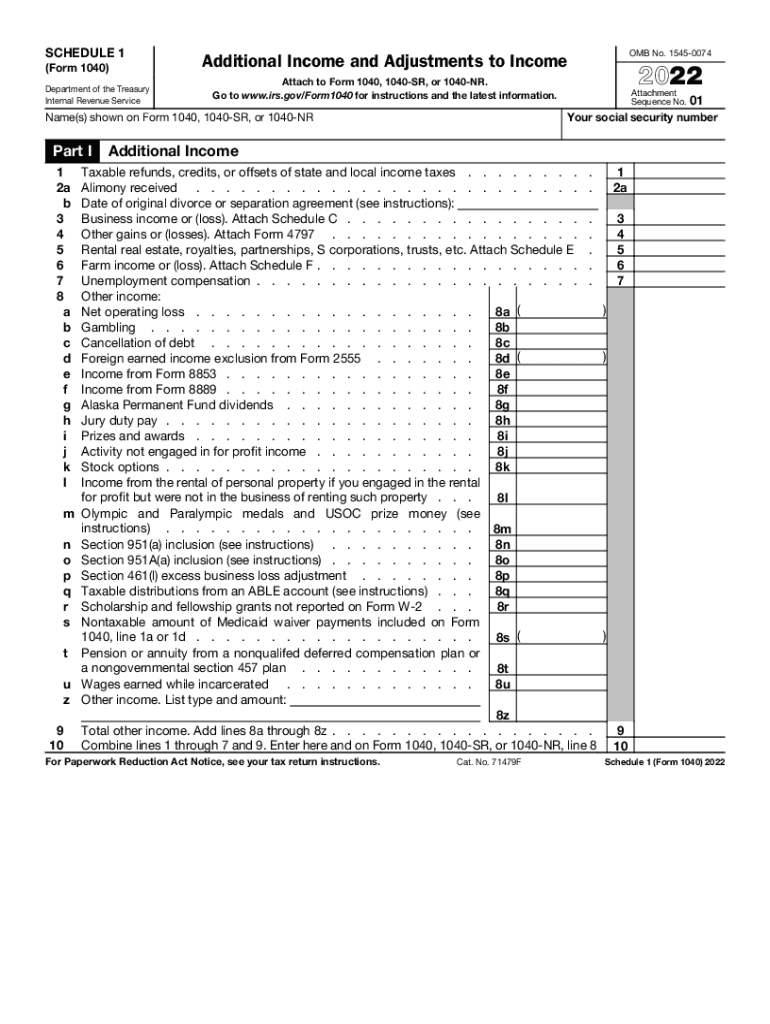

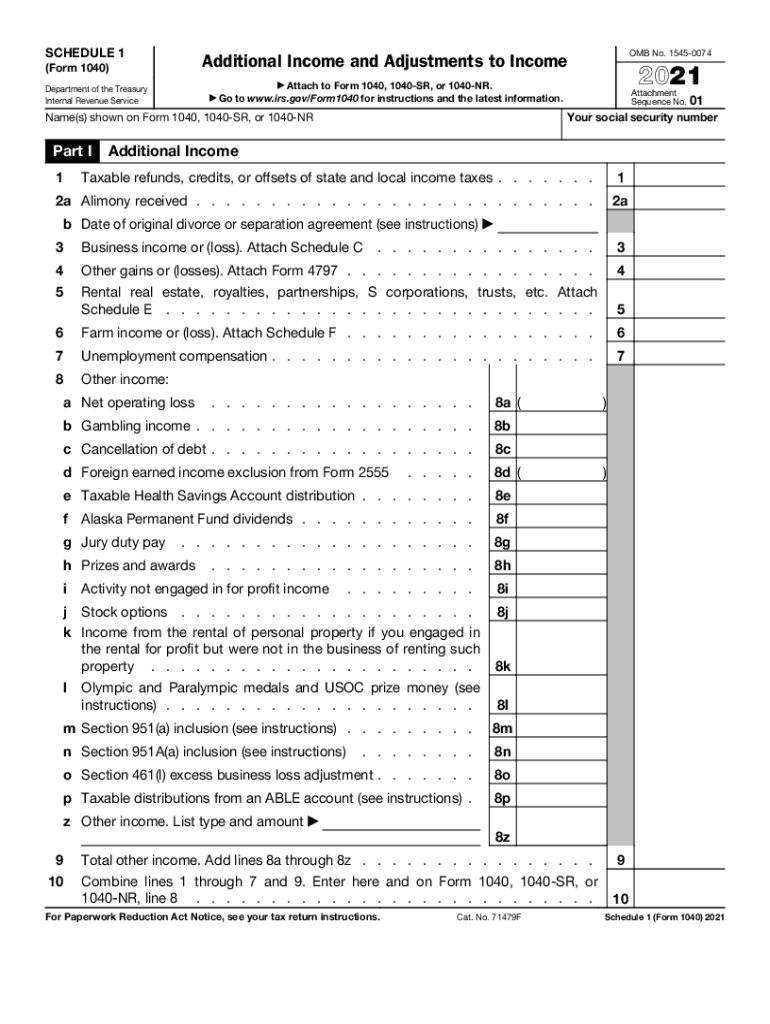

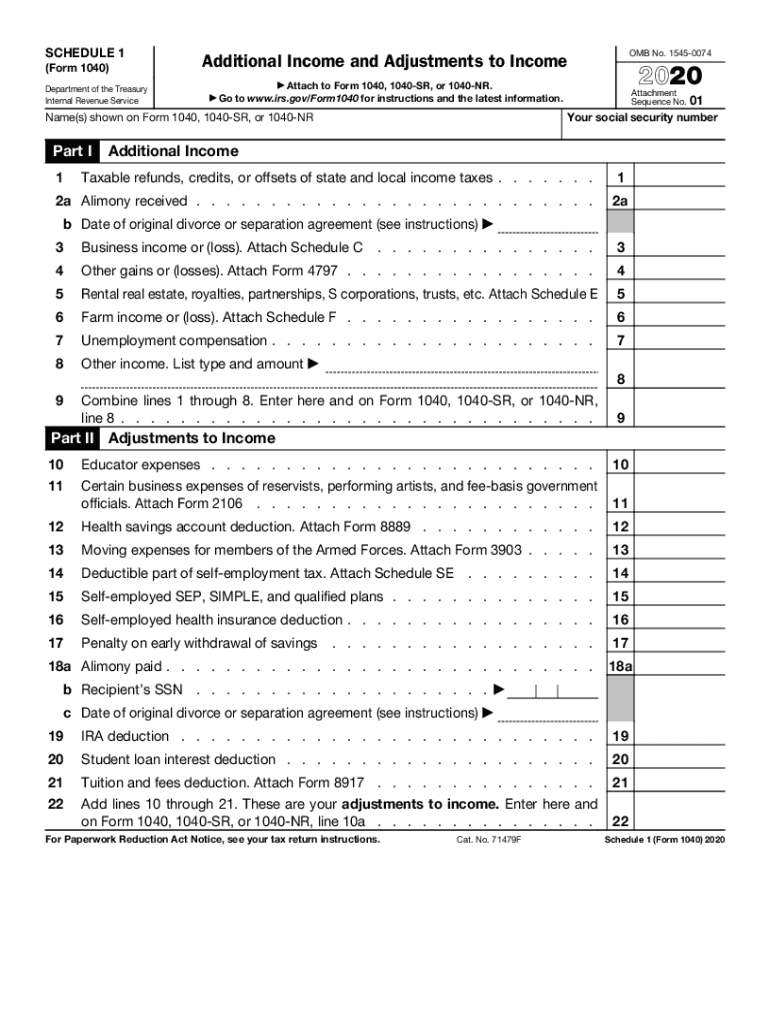

2024 Form 1040 Schedule 1 Line – The Schedule 1 form is used to report additional income or adjustments to income that are not listed on the standard Form 1040. It includes the addition of a new line for reporting . Form 1040, Schedule C, Line 1 Report all money you collected in your business on Line 1 of Schedule C. This amount should include all commercial sales taxes you collected. You do not need to .

2024 Form 1040 Schedule 1 Line

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS 1040 Schedule 1 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.comWhat is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comSchedule 1: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 Schedule 1 Line IRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template : The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, . The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for .

]]>